Under Armour Prepares To Increase Leverage Ratios

It is well known that leverage is good, or at least that's what we think when it comes to managing the finances of a company or even in real estate. The more we use other people's money to increase our wealth the better. However, given the position that Under Armour., Inc. (UA, UAA) is in right now it may be signaling a distressed balance sheet in the near future.

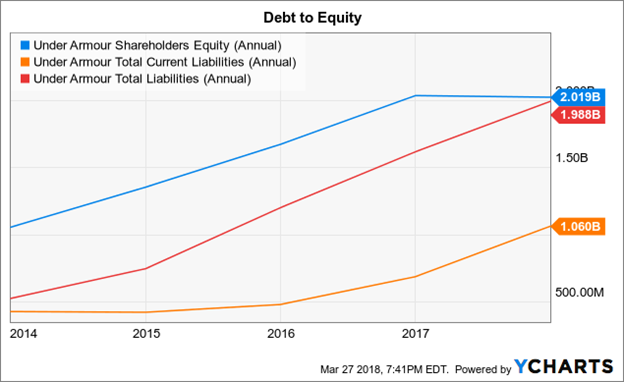

The company has come from having a somewhat conservative stance when it comes to debt-to-equity ratio in 2013 at a 49.77%, to being aggressive in 2017 at 98.47% , to being desperate in 2018 where it was announced in their 10K filing that "In February 2018, we amended our credit agreement to increase our permitted leverage ratio during certain quarters in 2018".

It is true that in the filing doesn't specify what type of leverage ratio they were talking. Nevertheless, taking a look at the Shareholder's Equity and comparing it with the Current Liabilities and the Total Liabilities we can see that it has changed significantly on both instances.

As you can see by the chart above, Under Armour., Inc. is at a crossroads with their debt. This chart is for the last 5 years, but taking a look back 10 years we can see that this is the first time their total liabilities reach their equity level. Having this with the fact that their revenue is softening may be a dangerous combination in the near future.

Disclosure: I am/we are short UA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Comments

Post a Comment